This fee is 5% of the transaction amount between £0.99 and a maximum of £2.99 GBP (which occurs at £60). B.1.1 International Fee (Sending from UK) There are no fees to send and receive GBP in the UK or to and from the following regions:īut to send money to the rest of Europe and other countries, you’ll need to pay the following. (1) International Fee (based on amount for Sender) Some may be charged to the sender and others to the receiver. However if currency conversion is required then a fee of 3 to 4% is the “currency conversion spread”įor more see official PayPal USA fees page. However, if you “Request Money” from friends and family outside of the US, there will be fees which may be paid mostly by the sender for their country. You can request money to be sent to you through an email, SMS or email. A.2.1 Receiving Money from Friends and Family In the US, transfers funded by your PayPal balance are free, while transfers funded by credit or debit cards are 2.9% of the amount. PayPal’s exchange rate for personal payments includes a 3% to 4% “currency conversion spread”. Lower fees are applicable for transactions below $100, and anything above $100 will attract the maximum fee of $4.99.

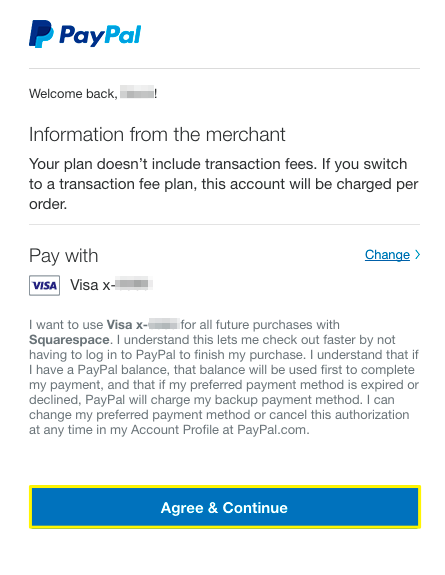

Whether you use your PayPal balance, a linked bank account, or a card (credit, debit, or PayPal credit), this fee is 5% of the amount ( minimum fee: $0.99 USD maximum fee $4.99 USD). For more information, see our disclosures here. Also, this post may contain offers and affiliate links to save you money. Please refer to the official documentation (links provided below). Turns out it can be much more than a few percent but more importantly I want to point out some of the excellent alternatives.įirst let’s figure out what your fees are.Īs a Start: Are you sending money to Family/Friends ? (below)īuying/Selling Commercial Goods and Services? (further below)īuying or selling goods overseas is covered briefly in our PayPal Commercial Section (below) Generally though, sending money to family and “friends” is cheaper and the majority of this page is dedicated to understanding these fees and reducing them!ĭisclosure/Disclaimer: While we have done our best to clearly explain PayPals fees, they will change things and we are human and can make errors. For more information on adding PayPal as a payment method, click here.I have been using PayPal for over a decade and to be honest I kind of ignored the international fees because every time I went to look into them I found it too damn hard to figure out!Īnd what’s a few percent here and there right? Click the Add Payment Method button to see all your options and pricing. To check Upwork's per-transfer fees for PayPal, click here. For example, PayPal India classifies transfers from Upwork as payments for services and therefore charges additional fees. PayPal also may charge additional fees based on your location. PayPal's outgoing withdrawal fees vary by method and currency choice (see PayPal's withdrawal fee calculator for details). In addition to the small, per-transfer fee Upwork charges, there may be additional costs on PayPal's side.

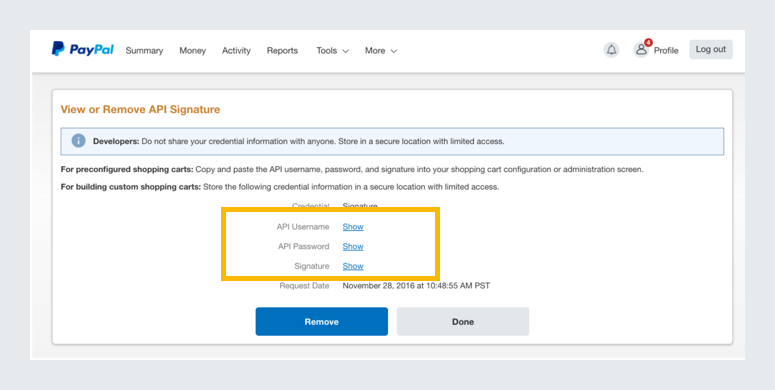

Paypal processing fees verification#

PayPal may limit your account functionality until you pass their verification procedures, and they usually require a bank account or credit card.

That way, you’ll be ready when it’s time to collect your earnings. For security reasons, you cannot use your PayPal account with Upwork for three days after you add it, so we suggest adding it or another payment method to your account as soon as you start submitting proposals.There are a couple of important things to know: To make transfers to PayPal, you must use your own registered PayPal account. If a transfer was initiated more than 24 hours ago and is still not complete, please contact PayPal. However, there are occasions when it may take up to 24 hours.

In most cases, payment transfers between Upwork and PayPal occur immediately. To add PayPal to your Upwork account, click here. That’s why we give you payment options, including PayPal. At Upwork, we’re always working to make processes as smooth as possible, especially when it comes to your money.

0 kommentar(er)

0 kommentar(er)